[ad_1]

CNBC’s Jim Cramer on Tuesday advised investors to put cash to work in oil now that the sell-off is largely over.

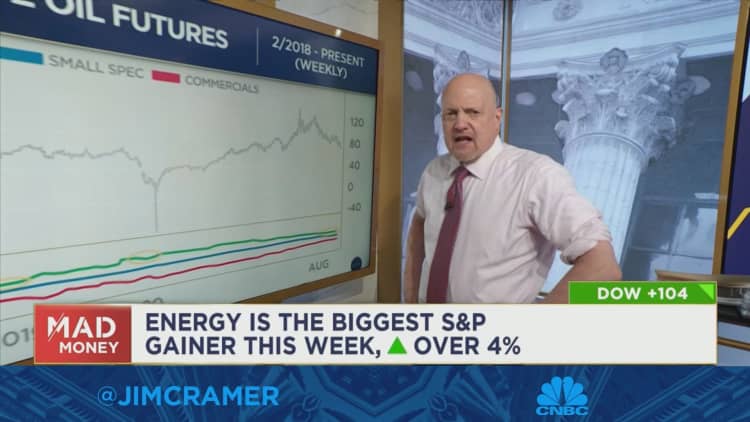

“The charts, as interpreted by Carley Garner, suggest that the oil speculators have been mostly wiped out, so it’s time to buy the dips because she wouldn’t be surprised at all if crude can rally another $20 from here,” he said.

Cramer said that Garner’s prediction of a wash-out in oil prices is panning out and oil could head higher as China reopens its economy and the Biden administration looks to refill the Strategic Petroleum Reserve anytime prices dip below $70 a barrel.

To explain Garner’s analysis, he examined the weekly chart of West Texas Intermediate crude futures, the U.S. benchmark for oil.

Garner believes that if not for the Covid pandemic-induced crash and Russia’s invasion of Ukraine, oil would’ve steadily climbed in a “bullish channel” starting in late 2019, according to Cramer.

“After each of those events, oil went back into the channel — notice that — which currently has a floor of support at $70 — you can see that — and a ceiling of resistance at $95,” he said.

Oil prices bounced off the $70 floor on Monday, and should be bouncing between these levels as long as the economy stays relatively stable, Cramer said. He added that while prices could dip lower to $65 if the market sees volatility over the holidays, Garner expects their upward trend to continue.

For more analysis, watch Cramer’s full explanation below.

[ad_2]